Your credit score is a big piece of your financial reputation. Without it, banks and other lenders wouldn’t have an idea of how trustworthy you are when it comes to money. This is why building up your credit is important if you want to have options and opportunities in the future.

Having a high score can be the difference when trying to get approved for a car loan, mortgage, or small business loan in the future. But what factors make up your credit score?

Factors that affect your credit score the most

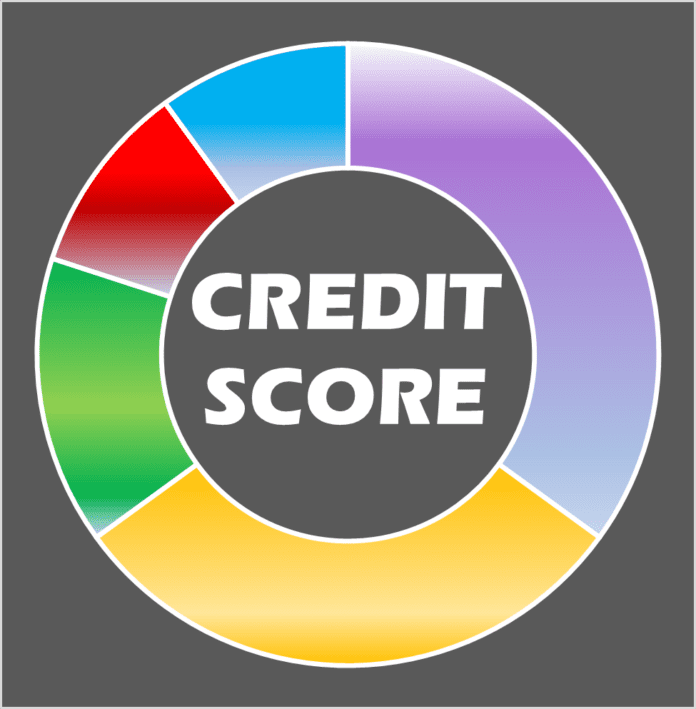

According to FICO, the most widely used analytics company for compiling credit scores in the U.S., there are five major factors that tie into your score. Each factor plays a role in showing a potential lender you are trustworthy, and each is weighted differently.

Payment History (35%)

Paying your bills on time accounts for more than a third of your credit score. This can be looked at as both positive and negative. The good news is that all you have to do is make payments on time to greatly improve your credit! The bad news of course being if you miss even a single payment your credit score will be affected.

Related: Tips when using a credit card

A good tip is to set a reminder on your calendar for your recurring payments. Or better yet, set up auto pay for all of your accounts.

Credit Utilization (30%)

Credit utilization is the percentage of your available credit that you are currently using. Let’s break that down to see what this credit score factor actually means.

Say you have a credit card with a credit limit of $10,000, meaning you can charge up to $10,000 before having to pay off the balance. When you have a $2,000 balance on the card that you haven’t paid off yet, your credit utilization is 20%.

FICO generally prefers to see a credit utilization of 30% or less. This will help show that you aren’t just racking up purchases that you can’t truly afford. Making sure to pay off your credit card bill every month or before it accumulates too high is a must.

Length of credit history (15%)

The length of time you’ve had credit accounts for significantly less than the first two factors of your credit score. This factor is a challenge for most people since not everyone knows about how credit works early on in life. However, there are way to improve on this whether you’re reading this at 15 or 35!

If possible, having credit accounts open sooner will benefit you in the long run. This means that opening a credit card or even taking out college loans can benefit your credit score. If you’re not comfortable taking out a credit card you can always become an authorized user on someone else’s account, like a parent. This way you can reap the benefits of maintaining an open credit account without the full financial responsibility.

Another tip is to keep your credit accounts open when feasible. This might not apply to college loans but keeping open an old credit card account? Absolutely! Even if you aren’t really using the credit card, leaving the account open will help improve this credit score factor.

Other credit score factors

There are few more smaller factors that make up your credit score – credit mix and recent credit checks. Each of these clock in at 10% of your credit score. Although smaller percentages, they still count.

Your credit mix is simply the variety of credit accounts you have open. Typically, most people will only see installment and revolving credit. Installment credit refers to loans that have fixed, regularly occurring payments such as car payments, mortgages, or student loans.

Revolving credit can include credit cards or home equity lines of credit. You can borrow from these lines of credit however you’d like up to the specified cap. A monthly payment is usually required plus you’re charged interest on any open balance you’re carrying on the account.

Finally, recent credit checks make up the last credit score factor. This just refers to the amount of times you’ve had your credit hard checked by a lender. This does not include when you check your credit score yourself.

If you are getting your credit checked frequently, it indicates that you are looking to apply for new debt of some kind, such as a credit card, mortgage, or car loan. Lenders might see this as riskier behavior if you’re consistently trying to take out more credit. The good news is that hard credit checks only stay with your credit score for a year or two.

What do credit scores ignore?

We talked a lot about what factors affect your credit score. Now, let’s see what factors don’t affect it.

Soft credit checks: As mentioned above, checking your own credit score will not affect anything.

Income/Bank Account Balances: Don’t have a lot of cash in your bank accounts? Don’t sweat it. Your credit won’t be affected by that or by what your salary is.

Rent and Utility Payments: If you don’t own a house, you will most likely be paying rent somewhere and paying for the utilities. This also won’t affect your score.