Lifestyle creep is a phenomenon where people tend to increase their spending as their income rises. It is a subtle and gradual process, where people slowly adjust their standard of living to match their income level. Most people tend to take their increased income for granted and start spending more than they should.

While lifestyle creep may seem like a natural progression for some, it can have serious financial consequences down the road. In other words, people tend to adjust their spending to their income level, rather than saving the extra income for their long-term financial goals.

Effects of lifestyle creep

Lifestyle creep can have negative repercussions on your financial life. First off, it can lead to the accumulation of unnecessary debt. If you continue to increase spending as your income rises, you may end up spending more than you can afford. This could lead to credit card debt, car loans, or expensive mortgages. This can have a negative impact on your credit score, making it difficult to obtain loans or credit in the future.

Related: Factors that affect your credit score

Secondly, at the very least you’ll miss out on the extra savings you could be accumulating from the income bump. This can make it difficult to achieve long-term financial goals. If you’re spending all your extra income, you’ll have trouble keeping an emergency fund or saving for retirement.

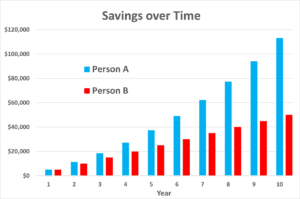

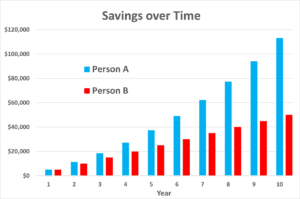

For example, let’s say two people at the same job both make $50,000 per year and their annual expenses are $45,000. Both employees get a 5% raise each year. Person A keeps their expenses the same (plus 3% average inflation) and Person B continues to increase their spending as their income goes up.

Over a 10-year span, person A saves more than double the money that person B does. Imagine all of the cash-producing assets you could buy with that extra money!

Who does lifestyle creep affect?

The concept of lifestyle creep can be seen across all income levels. Whether it is the entry-level employee who gets a raise, the middle-class family that moves to a bigger house or the affluent individual who indulges in more expensive luxury items, lifestyle creep affects everyone.

One of the primary reasons for lifestyle creep is the desire to keep up with the people around us. Social media and the pressure to fit in can influence people to buy more and spend more. So, just because you make a higher salary doesn’t mean that this can’t happen to you. The belief that a higher standard of living equates to happiness and success can be a dangerous mindset.

Buy assets, not liabilities.

The biggest mistake people make when earning additional income is buying liabilities with that money. That money is essentially going out the window to fulfill your want for a shiny new thing. Whether that be a brand-new car, the most expensive house you can afford, or an elaborate vacation.

Spending money on life’s luxuries aren’t frowned upon 100% of the time but there’s a time and place for them. But these shouldn’t be your first purchases as soon as you make a little more income. Buying assets with the extra money you’re saving should be your goal. Find assets that can produce money, not take your money. This can be in the form of stocks, bonds, or real estate, among others.

Related: How to budget in your 20s

Lifestyle creep can also lead to the illusion of wealth, where people may appear to be wealthy on the outside but are actually living paycheck to paycheck. For example, someone who buys a luxury car, rents a high-end apartment and frequently dines out at fancy restaurants may look like they have a high net worth. However, in reality, they may be living beyond their means and may have little to no savings.

How to avoid lifestyle creep?

So, what can be done to avoid lifestyle creep? The first step is to be aware of it. You should understand that your standard of living should be based on your needs and values, rather than your income. If you can identify your priorities and focus on what truly matters to you, they can avoid the pressure to keep up with others and resist the temptation to spend more than necessary.

You should make a conscious effort to save and invest the extra income you make. Instead of spending more when you earn more, you can put that money towards your long-term financial goals. By saving and investing, you can build a secure financial future and enjoy the benefits of financial freedom.