Deciding to either buy a house or continue renting is a big financial decision in your life. You’ve saved up some money, have a fairly stable job situation, and are now looking for your next move. Once you have your finances in order you will be in a great spot to make this choice.

Although there are both pros and cons to buying vs renting a house, we are only going to focus on the main reasons you should buy a house. Of course, this can be a scary financial decision but rest assured there are many benefits you’ll soon realize when you purchase a property.

Buying a house helps you grow wealth

The first and most important reason you should buy a house is because of the wealth building opportunities it presents. When it comes to property, financial wealth is measured in the form of equity, which is the value of your home minus the loans you have against it.

For example, if your house is worth $200,000 and your mortgage loan from the bank has $160,000 remaining on it, then your equity is $40,000. Think of equity as the theoretically value you would receive if you were to sell your house. You would receive the $200,000 from the buyer and then pay the bank the $160,000 you owe them. This leaves you with $40,000. This is a simple calculation, but we’ll show you why it’s so important to consider.

Since most people can’t afford to buy a house in cash, they use a mortgage loan to help fund the purchase. Then every month, a mortgage payment is made to the bank in return. That mortgage payment is split into two portions – interest and principal. The interest goes to the bank as a fee for them loaning you the money to buy the house. The principal goes towards paying down your loan balance.

Loan Paydown

As time goes on and you make more and more payments to the bank, your loan balance will decrease. Since equity is simply the value of your house minus your mortgage loan, your equity is slowly increasing with each payment you make.

This is why you might hear people say, “renters are just throwing money away”. As you can see, the payments you make on a mortgage are partially returned to you via home equity.

Related: How to budget in your 20s

You think gaining equity through loan paydown sounds good? Wait till you hear about appreciation!

Appreciation of your house

Appreciation is the increased value of an asset over time. Real estate typically increases about 3% year-over-year in value. Although that is not always a uniform increase, your house will generally go up in value over time. For the sake of the following example let’s assume a 3% appreciation.

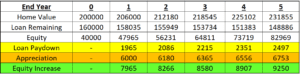

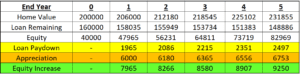

If you buy a house that’s worth $200,000 and put a 20% down payment on it ($40,000), the mortgage will be $160,000. Let’s use the common 30-year mortgage as the loan product with a rate of 6%. Your mortgage payment (not including insurance and property tax) will be about $960 per month.

Starting out, about $160 of that $960 monthly payment goes towards paying down the principal loan balance. This means your mortgage balance will go down about $2,000 over the course of year 1. The home value will also increase in by 3% over the year, equating to a $6,000. You just gained $8,000 in equity by simply making your mortgage payments for a year!

In addition, mortgages are structured to pay less interest over time. This means that your fixed mortgage payment will send more money towards your loan balance over time. That $2000 will go up every single year until your mortgage is paid off.

Even if we stick with 3% year-on-year appreciation, that doesn’t account for the power of compound interest. Every time you calculate 3% of your home’s value, you must consider the value going up every year. 3% of $200,000 is $6,000 in terms of appreciation gains but what about the next year?

The value is now $206,000 for year two. Now that $6,000 annual increase becomes $6,180 if you calculate 3%. Just like the loan paydown amount, this also continues to grow over time as shown below:

You can borrow against your home equity

Once you start to accumulate equity in your house, banks will allow you to borrow more money using your home as collateral. Assuming you are using the new loan for something responsible, this gives you more options financially.

You can upgrade your bathroom or kitchen, buy a second home, invest in more real estate, or start a business using your home’s equity. The possibilities are endless, but we do want to warn you again to be responsible. Purchasing liabilities or going on vacation using the equity is not recommended.

Having your home’s equity built up can also be a safety net for you and your family down the road. Just knowing you have additional money you can tap into if needed gives you better peace of mind.

Need some money to replace a roof or furnace and don’t have the cash to do so? Unforeseen disaster happened at the house? Using the equity from your home would be a good move because you’re putting the money you borrowed right back into your home!

Tax Benefits when you buy a house

Another reason you should buy a house is for the tax benefits. Here are some of the tax deductions you can claim from owning a home:

- Mortgage Interest

- Private Mortgage Insurance

- Property Tax

- Interest paid on borrowed equity via home equity loan or home equity line of credit (HELOC)

Buying a house could turn into an investment

Unless you plan on staying in the same house for the rest of your life, you can eventually turn buying a house into owning a cash-producing asset. Whenever you’re ready to leave, instead of selling your house you can just rent it out. You will avoid pay capital gains tax from a home sale and you can receive rent payments from a tenant. This will allow you to cover your mortgage payment and receive monthly cash flow. All the while you’re still gaining the equity through appreciation and loan paydown in the background.

Better yet, instead of just buying a single-family home you could also look into purchasing a multi-family home. Since you have to live somewhere, why not live in a property that immediately becomes an investment.

First off, you will receive cash flow from the others living in your building. This can help decrease your mortgage payments every month or even eliminate them completely if you find the right deal. Either way, this will make it cheaper than renting in most areas.

Buy a multi-family house

Along with the tax benefits mentioned above for a single-family house, a multi-family house allows you to write off some of the shared utilities and maintenance costs along with depreciation. The IRS allows you to deduct depreciation from the property at a rate of 3.6% of the property’s value. For example, if the house is worth $200,000 you could receive over $7,000 in tax deductions through depreciation alone!

These additional tax benefits are very useful for multi-family property owners as they will help offset the additional income earned through their tenants.

Also, if you eventually move out of your multi-family house you can just rent out your portion of the property and then you’ll have a cash-flow producing, equity-gaining asset in your portfolio. Just like turning a single-family home into an investment.

You can make your house your own

Usually, landlords will not let you alter the property when you move in. That means you can’t paint the place with the colors you want or make any additions. If you buy a house the place is completely yours to do what you want with it.

If you want to replace kitchen appliances, install new flooring, or add a new bathroom go ahead! As long as you can afford it no one can stop you. The space you retreat to after a long day out in the world can have a huge impact on your mental health. Having a home that you truly love coming back to is something that everyone should strive for.

You have to live somewhere!

This seems like a no brainer but it’s the truth. If you have to live somewhere, wouldn’t you want to be living in a home you can renovate to your liking, gain wealth from, claim tax deductions from, and potentially turn into an investment property one day?